Every time you drive through that corner chicken sandwich restaurant or pop into that popular donut and coffee shop (you know the ones we’re talking about), you are seeing the franchise model in action. As a customer, you are also actively helping to grow the local, state, and national economies.

And you get some seriously delicious dipping sauce out of the deal too!

Franchises are everywhere – you may not even realize how often you shop at a franchised business. From hardware stores and oil change services to mortgage brokerages, there is a wide variety of franchised businesses. Yup, franchising is a big deal. In fact, one in seven U.S. businesses is a franchise.

One in seven. Let that sink in.

That is a huge amount of economic power!

And… people LIKE franchises.

When they walk through the doors, they generally know what to expect of a franchised brand regardless of whether they are in New York or Newfoundland. Franchises are comforting in their familiarity, and a predictable experience combined with hometown ownership can mean more happy customers.

Franchises as Local Economic Heavyweights

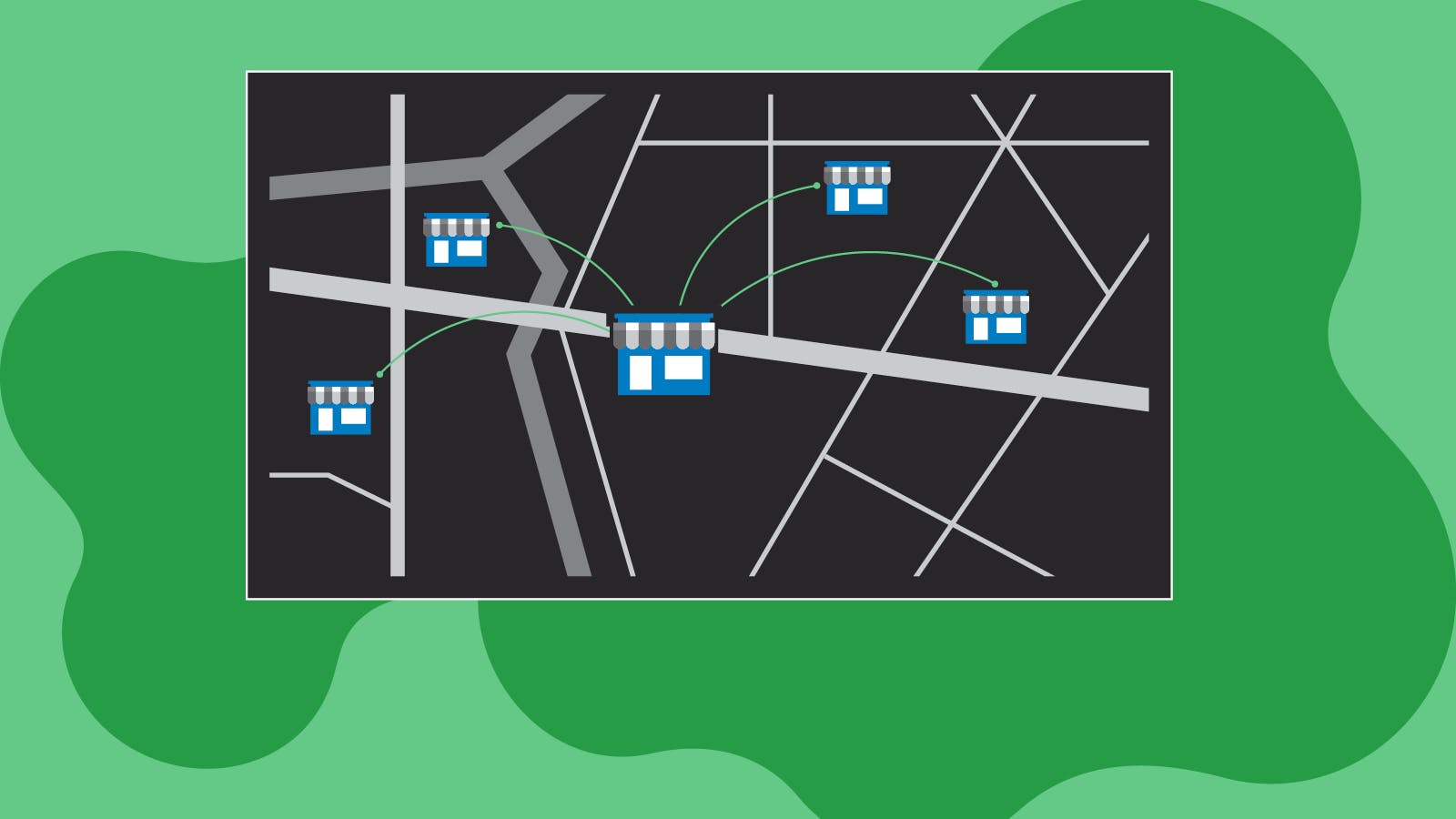

Franchised businesses are unique in that they can boost growth in local economies through their ability to quickly open multiple new locations in a given area. These fledgling businesses provide job opportunities for the local workforce at all levels – management, operational, support staff, etc.

More jobs mean less unemployment and less unemployment means more economic stability in general, even through economic ups and downs. The Bureau of Labor Statistics states that small businesses make up more than 60% of new jobs in the U.S and 2% of all small businesses are franchises.

Franchises can also provide a way for aspiring entrepreneurs to launch their own small businesses without having to start from scratch and can even include a proven game plan for operations.

New franchise businesses can be up and running more quickly, ready to hire employees, pay taxes to local governments, and contribute new goods and services to consumers and their local markets.

Fast-Tracking Small Business Success

50% of small businesses fail within 5 years, according to the Small Business Administration.

Training, administrative and marketing support, and established brand recognition provided by franchisors (like Motto’s brokerage-in-a-box solution) can make it much more likely for a new franchised business to succeed beyond that five-year mark. Want some cold, hard data to back that up? One five-year study by FranNet found that “92 percent of their franchise placements were still in business after two years and 85 percent after five years.”

Successful franchise businesses not only create jobs and revenue growth for themselves but also for vendors, suppliers, and other small businesses all the way up their supply chains.

More chicken sandwiches sold mean more chickens, flour, mixing bowls, napkins, etc needed from farmers and other suppliers, who in turn need more eggs/chicks, seeds, and help to meet demand. Then there are the people and companies that transport all this stuff, operate warehouses, provide packaging… the list goes on and on.

All this increased business also means more tax revenues paid that go to support schools, emergency services, and road repairs. Which in turn means…

You guessed it. Even more jobs.

Hello, economic boost!

From Chicken Fryers to Home Buyers

Now you might be thinking…. that’s all well and good, but selling homes is just a little bit different than selling birdfeeders or chicken sandwiches, right?

Turns out that mortgage brokerage franchises, like Motto Mortgage, can specifically help drive our economy forward in ways unique to the real estate industry.

By more easily connecting borrowers with the right mortgage products and lenders for their personal situation, real estate agencies are better able to seamlessly close deals. This often means more sales and a more stable community.

It also means those home inspectors, property valuation companies, home improvement contractors, interior design firms and all those other businesses on your vendor list will likely get more business too, leading to….

… more jobs, more revenue, more taxes, and yet more economic activity. Everybody wins!

Mortgage broker franchises can potentially help other businesses with financing through commercial mortgage loans, loan refinances, and investment property loans. Those businesses can then turn around and use the money to expand and grow.

Mortgage brokers can also be financial educators. They can help borrowers learn to navigate the mortgage process, various loan options, and general good financial habits This financial education can also give the economy a boost through more informed borrowing decisions and general financial well-being.

Franchising the American Economy

Franchises can be a huge contributor to the American economy through job creation, supporting other businesses, potential revenue generation, and generally helping to build a robust and dynamic business environment.

Mortgage broker franchises in particular can help contribute to better financial literacy, help grow real estate-related businesses, increase homeownership and financial stability, and provide other businesses access to financing options.

All of this can lead to stronger communities, more confident consumers with more cash to spend, a stronger business environment, and a brand that can inspire more loyalty and set you apart from your competitors.

So the next time you hear a favorable economic report in the news, raise a glass… (or maybe a chicken sandwich?)

Here’s to all the hardworking franchise owners out there, doing their best to help the American economy thrive!

Published on July 31, 2023